Remember the Republican plan to save the economy under Governor Doyle was the “sales tax holiday?”

Ideas like that don’t work under Republican administrations though, because now, in a complete flip flop:

Ideas like that don’t work under Republican administrations though, because now, in a complete flip flop:

Gov. Scott Walker has embarked on a major review of the state’s tax code, including the possibility of eliminating income taxes and raising the sales tax … cutting taxes could be a strong foundation from which to run for president, and Walker reportedly has his eye on a 2016 bid.

Another “bold” and courageous “promise(?)” made by Scott

Walker, as he moves as far away from “the old way of doing things” under the Democrats, to a more irresponsible gimmicky tea party way to look presidential.

Let’s see how realistic this new diversion tactic is:

Wisconsin relied on personal income taxes for almost 42 percent of its total tax revenue in 2012, according to the Census Bureau, or almost $6.8 billion of the nearly $16 billion it collected.

The state took in an additional $4.3 billion in general sales taxes, the only other revenue stream that produced anywhere near what the income tax does.

This shifts how the state will eventually get your taxes

anyway. Items that didn't include a sales tax will soak in the same amount of

cash from lower and middle income families as before, on all their income,

while the wealthy will see more of their money go tax free for saving and

investing.

I thought this comment said it best when it unwittingly made the point that if you spend less, you pay less...how's that good for the economy?

I thought this comment said it best when it unwittingly made the point that if you spend less, you pay less...how's that good for the economy?

"Sales tax seems the most equitable to me....those who buy more pay more. Buy less, pay less."

Incredibly clueless. As far as Walker's own comments, he chose to start with a lie:

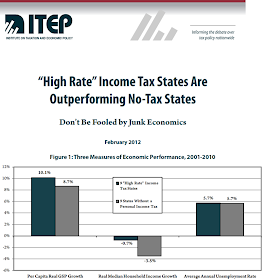

“There are many states that do very well, better than most states in the country, that have no income taxes,” Walker said, according to WisPolitics.

Not true at all, but he did make it sound wonderful. Here’s a graph from one of the more recent studies I’m sure will be

ignored like everything else not written by ALEC or other billionaire think

tanks. Voters in Wisconsin will only have themselves to blame for buying into

this new batch of voodoo economics:

Also a fun fact, 3 of the top 4 states for having people with no health insurance are states with no income tax. There are only 7 states with no income tax. I'll leave it up to you to fill in the blanks.

ReplyDeleteAlso, many of those no-income tax states collect big royalties on minerals, oil, and related mining activities (think Texass, S. Dakota, Alaska, and Wyoming). After all the money GTAC has poured into Walker's campaign, you think that would happen here? HAH!

Get ready for that 13% tax on food.

A rough calculation indicates that the state sales tax would need to be boosted to the 13%-15% range, or more if the corporate tax is lowered or eliminated. That means you can lop another 8%-10% off demand in a state in which wages are already falling. Making the lowest paid citizens absorb the greatest tax increase is indeed a zero sum game. It will be interesting to see which economist whores will be trotted out to proclaim the benefits of this policy.

ReplyDeleteRetail businesses in our border states will be ecstatic over all the new customers thanks to our genius Governor and the imbeciles in the Republican party. 'Escape from Wisconsin' will become their dominant advertising theme.